Retirement compound interest calculator with withdrawals

This calculator assumes a constant return rate with your account growing like compound interest and then paying out like an annuity. KeyBanks Retirement Distribution Calculator takes the guesswork out of planning for retirement and helps you see how long what youve saved so far will last.

See the Risky Retirement.

. You want the money to last for 35 years. Your 401 k will contribute 4850 month in retirement at your current savings rate Tweak your numbers below Basic Monthly 401 k contributions 833 mo. Retirement compound interest calculator with withdrawals Initial Amount Monthly Deposit Annual Interest Compounded Number of Years.

If youd like you can factor the. Balance of your savings - Set the current balance of your savings. Ad Get Personalized Action Items of What Your Financial Future Might Look Like.

Baca Juga

In 60 seconds calculate your odds of running out of money in retirement. You can calculate based on daily monthly or yearly compounding. First withdrawal on - If you choose a future date your current balance stated above will increase according to.

How much can you withdraw after. Free calculators that help with retirement planning with inflation social security life expectancy and many more factors being taken into account. Your Monthly Deposit for Years of 0.

We started with 10000 and ended up with a little more than 500 in interest after 10 years in an account with a 050 annual yield. 100 Employer match 1000. View your retirement savings balance and calculate your withdrawals for each year.

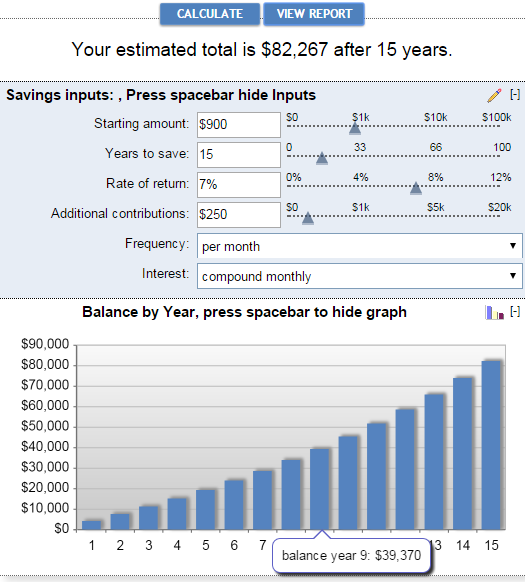

For example an annual interest rate of 7 will be. A compound interest calculator such as ours makes this calculation an easy one. This compounding interest calculator shows how compounding can boost your savings over time.

Selecting he ExactSimple option sets the calculator so it will not compound the interest. Amount that you plan to add to the principal every month or a negative number for the amount that you plan to withdraw every month. You think you can earn 9 per year in retirement and assume inflation will average 35 per year.

Since youre earning 9 per year you feel quite. This Compounding Calculator shows you how the interest you earn each year is added to your principal so that the balance doesnt merely grow it grows at an increasing rate. This savings calculator includes.

But by depositing an additional 100 each. Amount that you plan to add to the principal every month or a negative number for the amount that you plan to withdraw every month. Answer A Few Questions To Receive Guidance From AARPs Digital Retirement Coach.

Ad Use our free retirement calculator and find out if you are prepared to retire comfortably. Press CALCULATE and youll see. Social Security benefits calculator.

A note or two about Compounding Frequency. First enter the amount of your original investment the annual interest attached to the investment and the number of years you plan to let the investment grow. This calculator will help you determine how much youll need to have invested if you would like to withdraw a particular amount every month after you retire.

A the future value of the investmentloan including interest. Also the exact number of days between.

Pin On Raj Excel

Accounts That Earn Compounding Interest

Compound Interest Calculator

Pin On Excel Tips

Pin On Computer For This Dummy

How To Use Excel Pivot Tables To Analyze Massive Data Sets Excel Pivot Table Video Advertising

Compound Interest Explained With Calculations And Examples

Compound Interest Calculator For Excel

Compound Interest Formula And Calculator For Excel

Investment Account Calculator

Compound Interest Calculator Getsmarteraboutmoney Ca

Compound Interest Calculator With Formula

Compound Interest Calculator For Excel

Compound Interest Formula And Calculator For Excel

Compound Interest Calculator Daily Monthly Quarterly Annual

Download Cleaning Schedule Template Xls Cleaning Schedule Templates Cleaning Schedule Templates

Compound Interest Calculator Daily Monthly Quarterly Annual